Imagine a world where financial transactions are instantaneous, transparent, and accessible to everyone. This isn’t science fiction; it’s the rapidly approaching future of finance, powered by the disruptive forces of artificial intelligence (AI) and cryptocurrencies.

The financial world is undergoing a profound transformation. AI is rapidly altering the way we invest, manage finances, and even conduct everyday transactions. Are you ready to embrace the revolution?

AI-powered investment platforms are becoming increasingly sophisticated. These algorithms analyze massive datasets, determineing patterns and predicting industry trends with remarkable accuracy. This means smarter decisions, potentially higher returns, and an overall more efficient financial system. Think about the potential for personalized financial advice, tailored to individual needs and risk tolerances – something earlier unimaginable!

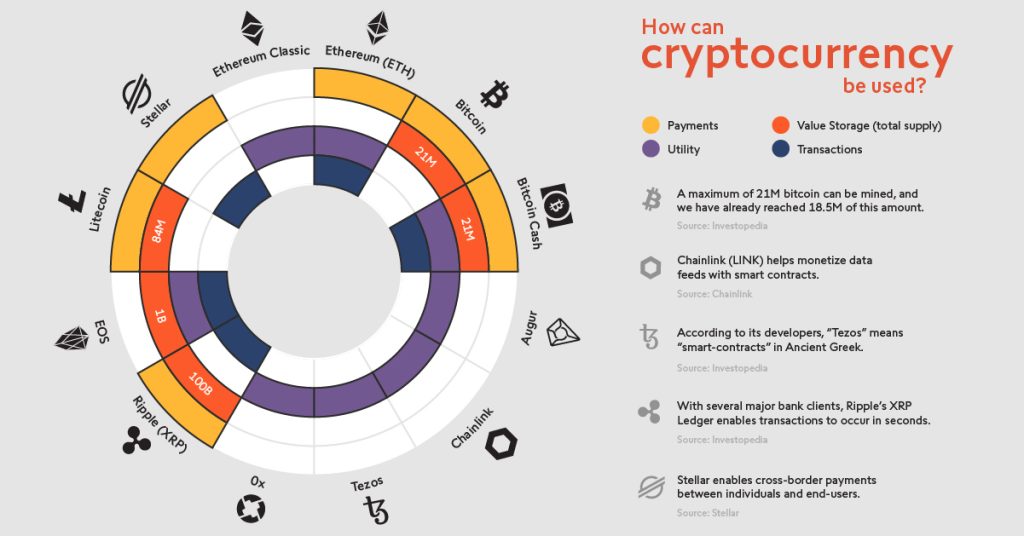

Cryptocurrencies, with their decentralized nature and blockchain technology, are challenging traditional financial institutions. Imagine a system complimentary from intermediaries, where transactions are secure and transparent. This opens up exciting possibilities for global financial inclusion, particularly for underserved communities. Is it time to consider the cryptocurrency landscape as a viable investment chance?

Decentralized Finance (DeFi) is gaining traction, offering alternative financial services and investment options. This model promises lower costs, greater accessibility, and potentially higher returns. This might mean new investment avenues and opportunities for entrepreneurship.

Related Post : E-Learning vs. Traditional Schools: Which One Is Actually Better?

How will this revolution impact traditional banks and financial institutions? It’s a complex query, but the answer likely lies in adaptation and innovation. The key is to embrace these new technologies, rather than resisting them. Can traditional finance adapt to the rise of AI and crypto, or will they be left behind?

AI is becoming a powerful tool for fraud detection and risk management, making financial systems more secure. Imagine a future where fraudulent transactions are identified and flagged in real time. This enhanced security could also lead to better cost efficiencies for institutions, providing better returns for customers.

Cryptocurrencies are poised to disrupt traditional financial systems, potentially making transactions faster, cheaper, and more transparent. Imagine a world with instant cross-border payments without the fees and delays of traditional systems. Is this the beginning of a financial revolution?

The integration of AI and crypto into the financial landscape is still in its early stages. Challenges remain, including regulatory hurdles and the need for improved infrastructure. The future of finance is full of potential hurdles as well as opportunities. Are we ready for this unprecedented change?

However, the potential benefits are enormous. AI and cryptocurrencies could dramatically improve access to financial services, particularly in developing regions. Imagine a future where everyone has access to affordable and reliable financial tools. Will this revolution ultimately benefit humanity as a whole or only a small elite group of individuals or institutions? Only time will tell. What function will you play in shaping the financial future of the world or are you simply going to follow along without much consideration for the potential consequences or benefits of this monumental change? What are your thoughts on this?

In short, the future of finance is dynamic and exciting. AI and crypto are reshaping the very fabric of how we handle money. We’re entering an era where possibilities once confined to science fiction are becoming tangible realities. Embracing change, learning, and staying informed are key to navigating this exciting new frontier.