Ever dreamed of effortlessly boosting your credit score by a whopping 100 points overnight? We’ll explore the crucial factors that impact your credit score, and share actionable strategies for sustained improvement.

Are you ready to discover the secrets to a healthier credit score? We’re diving deep into strategies for credit score optimization; not overnight fixes, but actionable steps for sustainable improvement.

Picture this: your credit score, like a meticulously crafted sculpture, needs time to come into form, not a magic wand to instantly transform it. You can’t just expect a quick, overnight fix. Real credit score improvement requires a fundamental shift in mindset, and a commitment to responsibility.

Imagine trying to build a strong, reliable structure, such as a house or a bridge, in an instant. Would it stand? Absolutely not! Similarly, real improvements in your creditworthiness require dedication and consistent effort. Credit score improvement is a marathon, not a sprint.

There’s no magic bullet, no secret formula, and definitely no credit score hacks. Instead, focus on building strong, lasting financial habits. Think of it like training for a marathon: consistent practice, proper nutrition, and mental strength lead to the finishing line. Consistency is key!

Related Post : E-Learning vs. Traditional Schools: Which One Is Actually Better?

Understanding the components that make up your credit score is essential. Payment history holds significant weight, reflecting your punctuality in repaying debts. A consistent payment history is a cornerstone of a great credit score. Imagine a well-oiled machine – smooth operations are essential. Your credit report is similar.

How about the amount of debt you carry? High-interest debt can drag down your credit score, much like a heavy load slows down a runner. Careful management of debt is crucial. Avoid accumulating unnecessary debt, and prioritize responsible borrowing. Think about using debt repayment strategies as part of your overall financial plan

The mix of varied types of credit you have in your credit mix can greatly impact your credit report. This reflects your creditworthiness, similar to a diversified investment portfolio offering balance. A balanced portfolio of credit accounts is crucial for building a thorough credit history.

Now, let’s talk about credit inquiries. Too many inquiries in a short timeframe can signal instability, like a ship tossed about in rough seas. Be mindful of credit applications, and try to time them strategically to avoid negatively impacting your credit score.

The length of your credit history is a vital factor. A longer credit history indicates a proven track record of responsible financial management, like a seasoned navigator familiar with the seas. The longer your credit history, the more well-rounded your credit score will be. Start building a history of responsible financial behavior early on to see the optimal outcomes in the future. Build and maintain healthy financial habits for maximum credit score potential!

What are the most common credit score mistakes people make?

How can I avoid these mistakes?

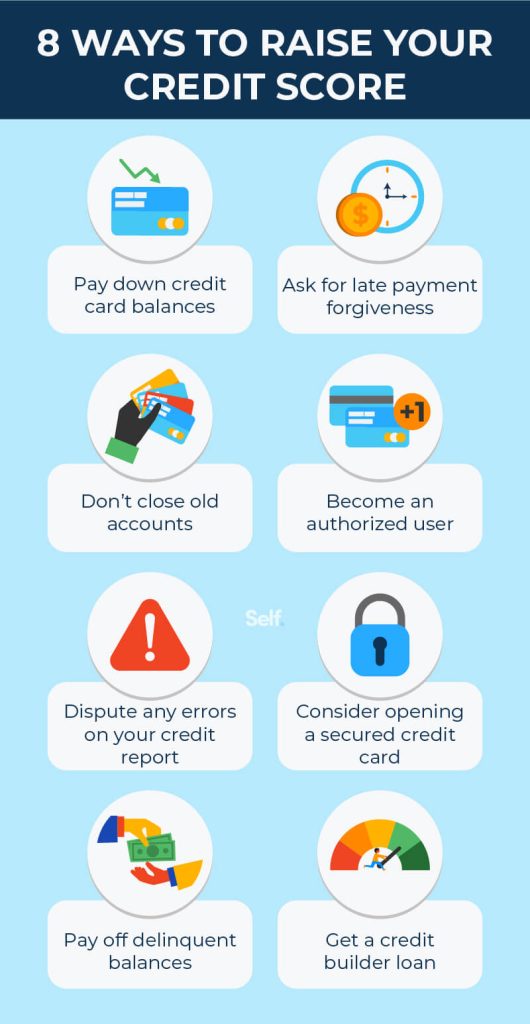

What are the most helpful and common sense credit score strategies that people should follow and understand? We’ve covered the essential facets that can help you improve your creditworthiness.

In closing, boosting your credit score isn’t a quick fix. It’s a journey requiring consistent effort and smart decisions. Remember, a healthy credit score is a valuable asset. Focus on responsible financial habits, and your score will naturally improve over time. Don’t fall prey to the myth of overnight credit score hacks; your financial well-being deserves a sustainable, proactive approach. We’ve shared strategies, not shortcuts, for a bright financial future.