Have you ever wondered how some people seem to effortlessly amass wealth? It’s not always about luck or inherited riches. Often, it boils down to a powerful financial principle: compound interest.

Imagine planting a tiny seed today. It might not seem like much now, but over time, that seed can grow into a towering tree, bearing fruit that nourishes you for years to come. Compound interest works in a remarkably similar way.

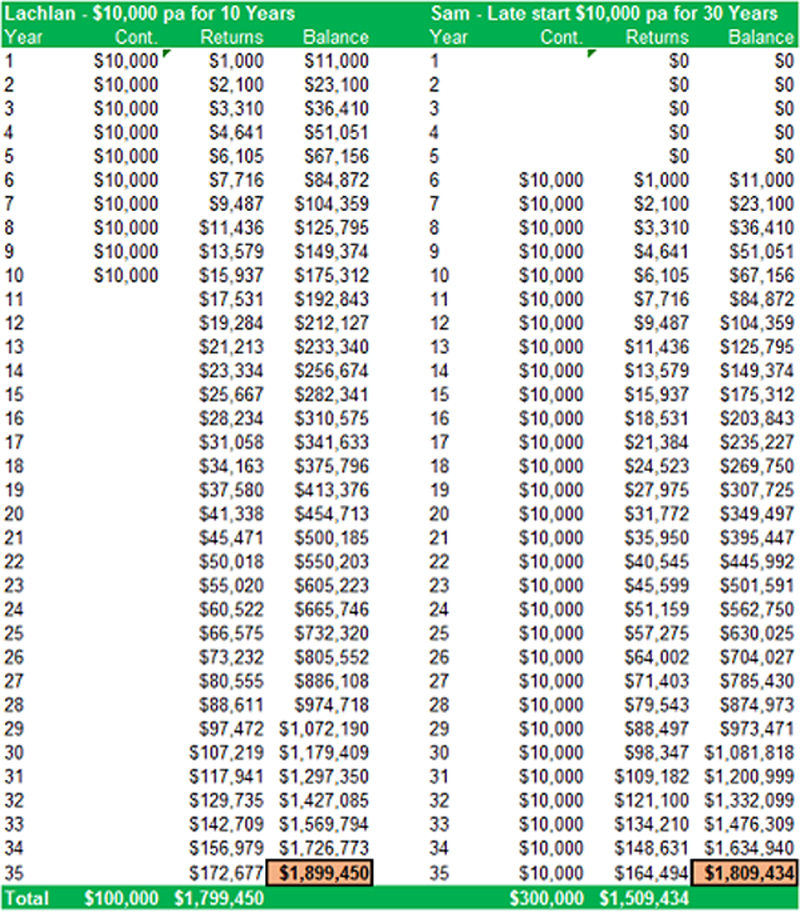

The beauty of compound interest lies in its ability to generate returns on your returns. It’s like a snowball rolling down a hill, gathering momentum and size as it goes. The earlier you start, the more time your money has to grow exponentially.

Let’s say you consistently deposit a small amount—say, $50 a month—into a high-yield savings account or a low-risk investment. Even small contributions, made consistently over time, can grow significantly. This is the essence of the compound interest miracle.

Think of it like this: You’re not just saving money; you’re also saving time. The more time your money has to grow, the more opportunities it has to generate returns. This is why starting early is so crucial.

Related Post : E-Learning vs. Traditional Schools: Which One Is Actually Better?

Many underestimate the power of compound interest, dismissing it as something for the wealthy. However, this couldn’t be further from the truth. Anyone can leverage this principle. By making small, consistent contributions to your financial future, you can witness its incredible outcomes.

How can we practically apply this knowledge? First, establish clear financial objectives. Do you want to buy a house? Fund your child’s education? Or simply achieve financial independence? Defining your objectives offers a roadmap for your savings plan.

Next, develop a budget. Track your income and expenses to determine areas where you can cut back or streamline your spending. Every dollar saved is a dollar closer to achieving your financial objectives.

Explore varied investment options tailored to your risk tolerance and time horizon. Consider a combination of high-yield savings accounts, certificates of deposit, or low-risk mutual funds for a diversified portfolio.

One powerful tip is automatic transfers. Set up automatic transfers from your checking account to your savings or investment account on a regular basis. This ensures consistent contributions without requiring extra effort or willpower. This regularity will help you stay on track towards your financial dreams. How else can we approach the matter practically and ethically to be achievementful? This is crucial in achieving a balanced approach towards achievement in life and financial well-being.

In closing, mastering the power of compound interest isn’t about overnight riches; it’s about consistent effort, patience, and a dash of savvy. Start small, track your progress, and watch your pocket change blossom into something truly remarkable. The journey towards financial complimentarydom is a marathon, not a sprint, and understanding compound interest is your secret weapon to win this marathon.